7th CPC Transport Allowance

- 7th CPC Transport Allowance

- Current Transport Allowance Rate

- 7th CPC Transport Allowance Order

- Admissibility of Transport Allowance for Central Government Employees

- Transport Allowance for Disabled Central Government Employees

- Transport Allowance – TPTA Cities

- Latest Transport Allowance Orders

- Transport Allowance FAQs

7th Pay Commission recommended the following rates of Transport Allowance to Central Government Employees

| Employees drawing pay in Pay Level | Rates of Transport Allowance per month | |

|---|---|---|

| Employees posted in the cities as per Annexure | Employees posted at all Other Places | |

| 9 and above | Rs. 7200 + DA thereon | Rs. 3600 + DA thereon |

| 3 to 8 | Rs. 3600 + DA thereon | Rs. 1800 + DA thereon |

| 1 and 2 | Rs. 1350 + DA thereon | Rs. 900 + DA thereon |

Current Transport Allowance Rate

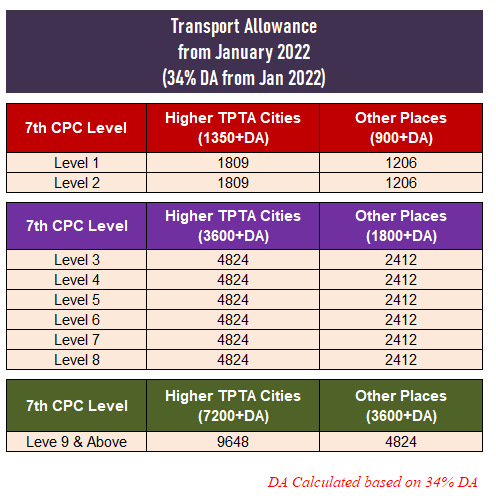

Transport Allowance calculated based on the current DA, considering the current DA rate i.e. 34% from January 2022 following TA Rates will be applicable from Jan 2022

7th CPC Transport Allowance Order

After the 7th CPC Recommendation for Transport Allowance, FINMIN accepted the recommended allowance and released the Office Memorandum on No.21/5/2017-E.II (B) dated 7th July 2017 with the subject Implementation of the recommendations of the 7th Central Pay Commission relating to grant of Transport Allowance to Central Government employees. [ Click here to view the FINMIN order].

Admissibility of Transport Allowance for Central Government Employees

(a) During Leave: The allowance will not be admissible for the calendar month(s) wholly covered by leave.

(b) During deputation abroad: The allowance will not be admissible during the period of deputation abroad.

(c) During Tour: If an employee is absent from the Headquarters /Place of Posting for full calendar month/months due to tour, he/she will not be entitled to Transport Allowance During that/those calendar month/months. However, if the absence does not cover any calendar month(s) in full, Transport Allowance will be admissible for full month.

(d) During training treated as duty: The allowance may be granted during such training, if no Transport Facility/ Traveling Allowance /Daily Allowance is provided for attending the training institute. During Official tour in him training course, the allowance will not be admissible when the period of the tour covers the whole calendar month. Also, during training abroad, no Transport will be admissible when the period of such training covers the whole calendar month.

(e) During inspections /survey duty by Members of Special Parties within the city but exceeding 8 kms. From the Headquarters or during continuous field duty either in or outside the Headquarters: Transport Allowance is given to compensate for the expenditure incurred for commuting for both to and fro between the place of duty and residence. In case when one gets Road Mileage/Daily Allowance or free transportation for field/inspections /survey duty or tour for a period covering the whole calendar month, he/she will not be entitled to Transport Allowance during that calendar month.

(f) To vacation staff: Vacation staff is entitled to Transport Allowance provided no free transport facility is given to such staff. However, the allowance shall not be admissible when such vacation spell, including all kinds of Leave, cover the whole calendar month(s).

(g) During Suspension: As a Government employee under suspension is not required to attend office, he/she is not entitled to Transport Allowance during suspension where suspension covers full calendar month(s). This position will hold well even if the suspension period is finally treated as duty. Where suspension period covers a calendar month partially, Transport Allowance payable for that month shall be reduced proportionately.

Transport Allowance for Disabled Central Government Employees

The persons with disabilities employed in Central Government, as mentioned in Para 2(iii) of OM No. 21/5/2017-E.II(B) dated 07.07.2017 regarding grant of Transport Allowance as per 7th CPC rates, are eligible to draw Transport Allowance at double the normal rates + DA thereon, irrespective of whether they are residing within the campus – housing the place of work and residence or Govt. or private accommodation within one km. of office.

Ref O.M No. 21/3/2017-E.IIB dated 12th July, 2018

Transport Allowance – TPTA Cities

LIST OF CITIES/TOWNS ELIGIBLE FOR HIGHER RATES OF TRANSPORT ALLOWANCE ON RE-CLASSIFICATION OF CITIES/TOWNS AS PR CENSUS- 2011 (w.e.f 01.04.2015)

| S. No. | NAME OF THE STATES/ UNION TERRITORIES | NAME OF THE CITY/TOWN |

|---|---|---|

| 1 | ANDAMAM & NICOBAR ISLANDS | – |

| 2 | ANDHARA PRADESH/ TELANGANA | HYDERABAD (UA) |

| 3 | ARUNACHAL PRADESH | – |

| 4 | ASSAM | – |

| 5 | BIHAR | Patna (UA) |

| 6 | CHANDIGARH | – |

| 7 | CHHATTISGARH | – |

| 8 | DADRA & NAGAR HAVELI | – |

| 9 | DAMAN & DIU | – |

| 10 | DELHI | Delhi (UA) |

| 11 | GOA | – |

| 12 | GUJARAT | Ahmadabad (UA), SURAT (UA) |

| 13 | HARYANA | – |

| 14 | HIMACHAL PRADESH | – |

| 15 | JAMMU & KASHMIR | – |

| 16 | JHARKHAND | – |

| 17 | KARNATAKA | Bangalore / Bengaluru (UA) |

| 18 | KERALA | Kochi (UA) , Kozhikode (UA) |

| 19 | LAKSHADWEEP | – |

| 20 | MADHYA PRADESH | Indore (UA) |

| 21 | MAHARASHTRA | Greater Mumbai (UA); Nagpur (UA), Pune (UA) |

| 22 | MANIPUR | – |

| 23 | MEGHALAYA | – |

| 24 | MIZORAM | – |

| 25 | NAGALAND | – |

| 26 | ODISHA | – |

| 27 | PUDUCHERRY/ PONDICHERRY | – |

| 28 | PUNJAB | – |

| 29 | RAJASTHAN | Jaipur (UA) |

| 30 | SIKKIM | – |

| 31 | TAMILNADU | Chennai (UA), Coimbatore (UA) |

| 32 | TRIPURA | – |

| 33 | UTTAR PRADESH | Ghaziabad (UA), Kanpur (UA) , Lucknow (UA) |

| 34 | UTTARAKHAND | – |

| 35 | WEST BENGAL | Kolkata (UA) |

Latest Transport Allowance Orders

[catlist id=524]

Transport Allowance FAQs

What is the Transport Allowance?

Transport Allowance (TPTA) is granted to cover the expenditure involved in commuting between place of residence and place of duty

What is the 7th Pay Commission recommendation for Transport Allowance?

The 7th Pay commission recommended the following rates of Transport Allowance.

Pay Level 1 & 2: Rs.1350+DA for Higher TPTA Cities & Rs.900+DA for Other Places

Pay Level 3 to 8: Rs.3600+DA for Higher TPTA Cities & Rs.1800+DA for Other Places

Pay Level 9 and above: Rs.7200+DA for Higher TPTA Cities & Rs.3600+DA for Other Places

Whether Transport Allowance is same for all the places?

No, Transport Allowance is divided into two places, Higher TPTA Cities and other places.

How many places covered under Higher TPTA cities?

Around 19 Cities coved under Higher TPTA cities

An employee get transfer from higher TPTA city to lower TPTA city but retains the quarters at higher TPTA city. Whether he will get higher or lower TPTA allowance?

Will the Transport allowance slab (7,200, 3600, 1350 )+ DA will change to (9,000, 4500, 1688-25% increase) + DA on reaching Dearness allowance cross 50%

No such recommendations

Employee is eligible for Transport Allowance under Salary. Employee is eligible for Travelling Allowance during tour.

Is transport allowance is eligible for the employees who are getting travelling allowance. What are the conditions

What’s the rate of transport allowance for cities adjoining Delhi i.e Gurgaon, Faridabad & Noida where rate of HRA is at par with Delhi?