Budget 2020 : Income Tax New Slabs

New Income Tax Slabs

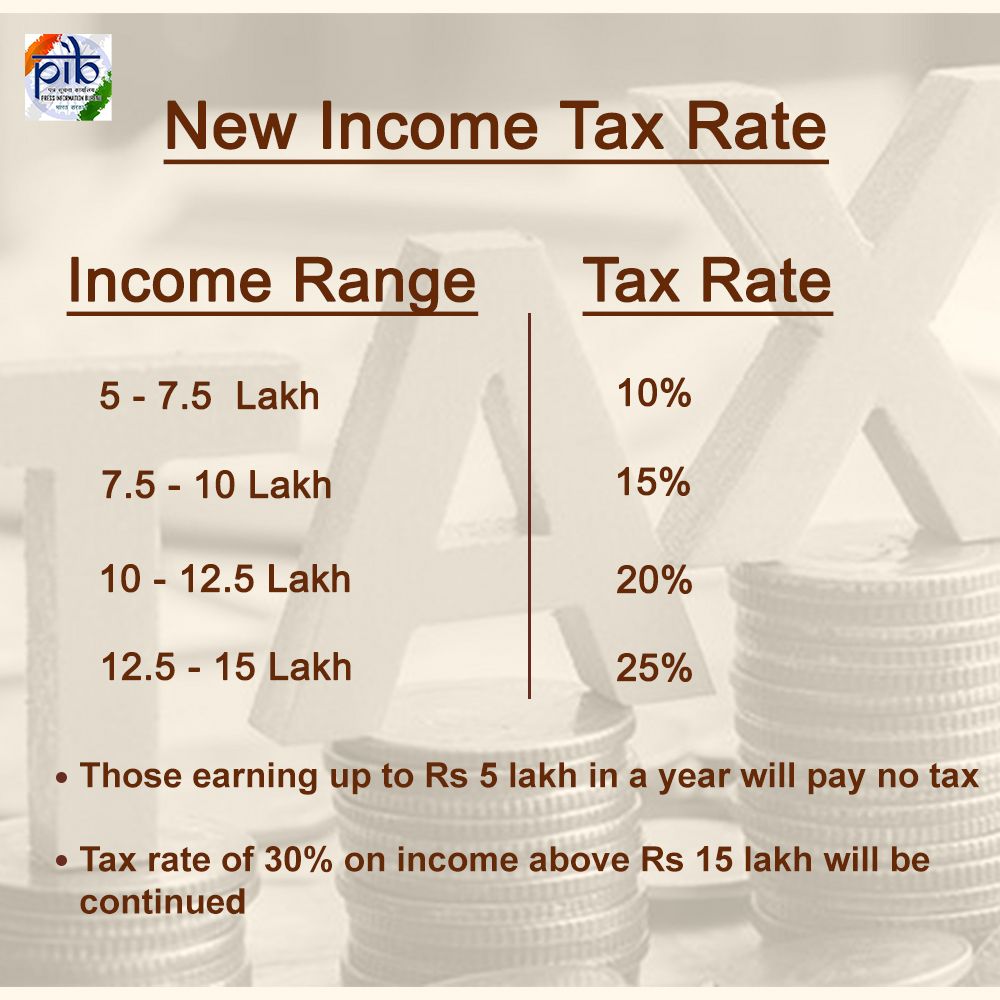

- No tax for income below Rs 5 lakh

- 10% for income between Rs 5 – 7.5 lakhs (down from 20%)

- 15% for income between Rs 7.5 – 10 lakhs (down from 20%)

- 20% for income between Rs 10 – 12.5 lakhs (down from 30%)

- 25% for income between Rs 12.5 – 15 lakhs

- 30% for income more than Rs 15 lakh onwards

| Income | Tax |

|---|---|

| Upto Rs. 5 Lakhs | NIL |

| Rs 5 lakh to Rs 7.5 lakh | 10% |

| Rs 7.5 lakh to Rs 10 lakh | 15% |

| Rs 10 lakh to Rs 12.5 lakh | 20% |

| Rs 12.5 lakh to Rs 15 lakh | 25% |

| Above Rs 15 lakh | 30% |

- A person earning Rs 15 lakh per anum and not availing any deductions will now pay Rs 1.95 lakh tax in place of Rs 2.73 lakh

सरकार ने नया बजट में वरिष्ठ नागरिक के लिए आय कर स्लैब में कोई अलग से प्रावधान नही किया है तथा सरकार द्वारा सरकारी कर्मचारी के सामान्य

भविष्य निधि में बचत की जाने वाली निधि के बारे में कोई उल्लेख नही किये है

This is not a reply but comments and query..

We talk about 5 laks free of income tax but no body talks about the tax one has to pay from 2,5 lakhs to 5 lakhs @ 5%.

In the budget speech FM has not mentioned slabs for senior citizens and super senior citizens. Will some one clarify whether they will be the same as in the earlier regime.

I pay less I tax in the previous regime and will follow the same. New I tax structure is beneficial to those who are not investing to save tax

I have to pay more tax on the dividends I receive. The budget has this negative impact on me.

Please inform on

Deduction from 80C to 80U

Senior Citizen slab

Super Senior Citizen slab

Standard DeductionRs 50,000/-

80 TTB of Rs 50000/-

बचत को भूल गई सरकार बचत को कोई प्रोत्साहन नहीं दिया गया है

She has not given any benefit opto & seven lakhs.

It is a good relief to direct tax papers. They have to enact a legislation compulsorily to file IT returns irrespective of their earnings if anyone attains 25 years of age, may they be tax / non tax payers. If they get nil tax, it will be NIL return or else the tax to pay whatever may that be. Secondly, all purohits, archaks, matadipathis, petty shop vendors, street sellers are transacting through cash. Their income cannot be identified and they will not pay any tax, though they earn avarage Rs.40000/- p.m. Rs.450000 to Rs.500000. If this is done tax will be doubled to the central government. Average every labourerer, carpenter, plumber..so on earns Rs.1000 to Rs.1500/- per month. Astrologers threatening their customers saying homa and havanas grab Rs.70000 to 80000 and more. Their annual income will reach rs.650000 to 700000. They do not pay taxes because of cash they receive.

Is there any deduction

Please inform the types of Deduction in 80C to 80U

Standard deduction

80TTB

Senior Citizen Slab

Super Senior Citizen

Thanks

BCDDASMOHAPATRA

[email protected]